In The Name of Allah The Beneficent The Merciful Announcement Concerning: The Crescent Moon of…

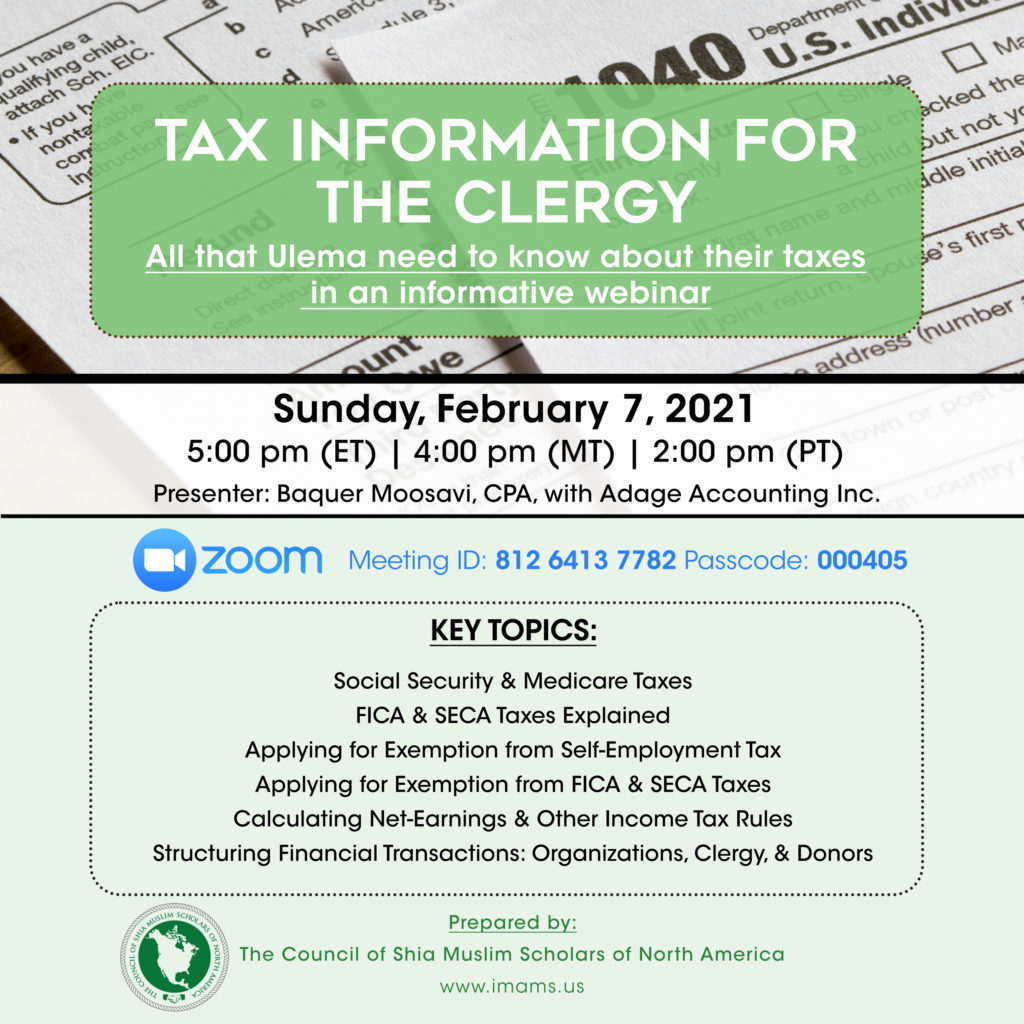

Tax Information for the Clergy

All that Ulema need to know about their taxes

in an informative webinar

Sunday, February 7, 2021

5:00 pm (ET) | 4:00 pm (MT) | 2:00 pm (PT)

Presenter:

Baquer Moosavi, CPA, with Adage Accounting Inc.

Meeting ID: 812 6413 7782 Passcode: 000405

Key Topics:

Social Security & Medicare Taxes

FICA & SECA Taxes Explained

Applying for Exemption from Self-Employment Tax

Applying for Exemption from FICA & SECA Taxes

Calculating Net-Earnings & Other Income Tax Rules

Structuring Financial Transactions: Organizations, Clergy, & Donors

Prepared by:

The Council of Shia Muslim Scholars of North America